Only two months ago, it seemed as if the world economy was well recovering from the 2007 financial crisis. Companies were flourishing, the living standard in a lot of developing countries was getting higher, and consumerism was at a rising point. Absolutely no one expected a mere virus could put a stop to all this and bring our entire system as we know it to a test.

Many are wondering, what now?

We Need a Quick Fix

Most governments are genuinely worried about how businesses will handle this situation. However, not many countries can afford to help their private sectors, at least for now. On top of that, the health care systems are crumbling under the pressure of the new virus and the number of infected people across the globe. This automatically means that most governments will prioritize helping hospitals instead of corporations.

For companies in many countries, this means that they will have to rely on themselves; or to be more precise, on the money they managed to save up over the years. The situation the world is currently facing came out of the blue, and as such, nobody was prepared for it. Now, what are the plans corporations are coming up with, and does it by any chance include taking advantage of the crisis?

Who Is Protecting the Buyers?

Due to the pandemic, countries don’t have the time nor resources to monitor their taxpayers properly, which automatically means that buyers are quite unprotected. Has what we feared the most started to happen?

Due to the pandemic, countries don’t have the time nor resources to monitor their taxpayers properly, which automatically means that buyers are quite unprotected. Has what we feared the most started to happen?

In times like these, the population rests on the idea that producers of general goods and medical supplies will keep their prices intact, competing with each other and creating the best price for consumers. Unfortunately, the percentage of those who are taking advantage of the epidemics is rising.

According to this NY Times article, many pharmacies in the USA alone have raised the prices of their products within a day, making them twice, if not three times more expensive than only 24 hours before. A lot of consumers have started complaining that some supermarkets have started doing the same thing. This is where a country’s tax system comes in to play, and it might be the right time for every government to assess the functionality of its tax collection system. This system serves as the forefront in protecting both the general population and the economy of a country.

So, how modern are these systems? Are they digital yet? And can they actually help their governments the way they were intended to? The sad truth is that in most countries, they’re not. They are somehow still stuck in the 20th century, and this might be the right time to consider a change.

TaxCore Offers the Perfect Solution

As a platform, TaxCore offers the most modern tax collecting system that ensures transparency. Moreover, it has demonstrated to be the best tool to fight against TAX evasion and VAT fraud in the countries that implemented it. Our platform allows for tax offices to have an insight into every single receipt going through a system, no matter whether it comes from a supermarket, pharmacy, gas station or a restaurant.

And while some governments are now faced with a problem of controlling the prices of medical supplies, the countries which implemented TaxCore know exactly whom to keep their eye on.

In a recent development, the president of Russia, Vladimir Putin, was asked what to do with drugstores that raised the prices of face masks, and his answer was short and to the point – revoke their licenses. Although quite an effective solution, having a good tax system could easier help identify businesses that are breaking the local laws better, and separate bad apples from good apples.

How Do We Protect Consumers’ Rights?

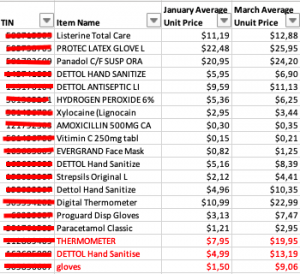

All over the world, people have started panic-buying the necessities, medicine included. In the Republic of Fiji, as of March 19th when the state of emergency has been declared by the Prime Minister, TaxCore has registered a major increase in prices of face masks, antibiotics, and painkillers.

A lot of pharmacies have started selling face masks for prices of up to 2 or 3 times higher. Checking our TaxCore database, we easily confirmed that the difference in prices of these products from January up to today was over 15%.

Having a clear insight in these practices, the FRCS (Fiji Revenue and Customs Service) can easily put an end to these. All the proof they might need is already in the system, so they can easily penalize any business taking advantage of the present situation.

Once the epidemic comes to an end, one thing remains for sure – many governments will have to make a significant change in the way they govern local economic activities. And the change must come from modernizing taxation in the first place. To see how TaxCore can help you in times of crisis, feel free to get in touch through our contact us page.