There are a couple of main principles when digitalizing the process of tax revenue monitoring (be it fiscalization or e-Invoicing). Principles such as the immutability of data, non-repudiation of taxpayer identity, and the (near) real-time reporting of transactions. Another equally important principle, that sometimes gets overlooked, is the ability to instantly verify the invoice’s authenticity and validity. Nowadays, this is most often done by placing a QR code on invoices that recipients scan, easily verifying their invoice. But how can this be helpful to the Tax Authority (TA) as well?

The difference maker is the amount of data that can be “packed” in a QR code and what happens to that data after the verification. In TaxCore®, QR codes contain plenty of important data, all of which is shared with the TA upon scanning:

- Seller Identity

- Buyer Identity (usually just for B2B)

- Document Type and Total Counters

- Date and Time

- Invoice and Transaction Type (and their total counters)

- Encrypted Accumulated Totals (internal data)

- PKI-based digital signature

To understand just how useful this can be for the TA, let’s look at a short case study.

A short study on its usefulness

A taxpayer has been creating fiscal invoices but has not been reporting all the transactions regularly (which can happen unintentionally, due to equipment malfunction). In normal circumstances, there would be no way for a TA to know of this without a targeted field visit.

However, thanks to the comprehensive data shared with the TA and the blockchain approach in TaxCore®, it is enough for just one customer to scan the invoice QR code and all accumulated information about the previous invoices will also be transferred to the TA.

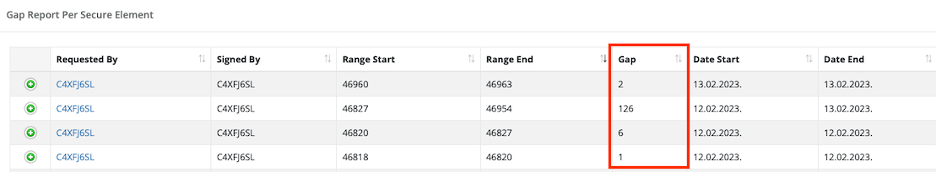

When information about a scanned invoice arrives at the TaxCore®, this invoice is stored in the system, which then checks whether it has received all previous invoices according to their unique invoice number. If some invoices are missing, a gap will be recorded in the system until all the invoices are properly reported. TA officers can use a portal interface for a quick and simple view of all the gaps.

The numbers in Range Start and Range End columns mark the unique numbers of invoices that have been stored in the system. In this case, all those invoices have been transferred to the TA via a QR code scan.

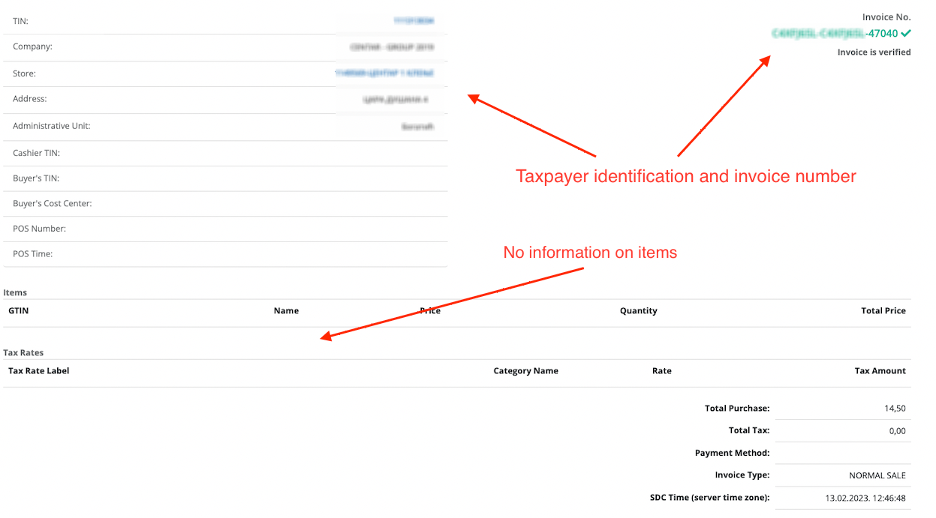

For this reason, there are no items in the stored invoice details. Nevertheless, because of the digital signature, there is non-repudiable information about the taxpayer and the unique invoice number.

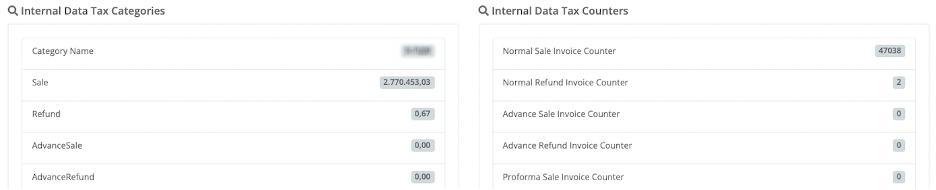

TA officers can access the invoice’s internal data and see the accumulated total for previously issued invoices including the total number of issued invoices and total tax liability.

TaxCore® and taxpayer’s tax liability

As you can see, the proper application of a QR code on an invoice can be extremely helpful in identifying taxpayers who have not been reporting their transactions regularly. Even in those situations, TaxCore® users do not need to worry about losing information about the taxpayer’s tax liability.