TaxCore®

Revenue Compliance Done Right

TaxCore® is a revolutionary tool for tax authorities to fight against the grey economy and tax fraud in the most flexible and convenient manner. The TaxCore® platform is fully digital, secure, and adaptable. It can be installed in environments with full Internet capacity or in environments where the Internet connection is weak or scarce.

Total invoices processed

by TaxCore® worldwide

3000015

M

Everyone is motivated to fight the grey economy!

TaxCore® equally benefits all stakeholders – taxpayers, consumers, government entities, and developers within the invoicing ecosystem. It was built with the idea that there must be transparent and clear communication between taxpayers and tax authorities.

This establishes a system where taxpayers are motivated to pay taxes by witnessing how the government reinvests them into various projects and industries for the benefit of all.

Benefits

For Tax Authorities

1

Significant increase in tax collection due to the registration of taxpayers' turnover;

2

Decreasing activity of gray economy share due to organized evidence of registered taxpayers, their activities, and their sales locations;

3

Suppression of tax evasion due to the comprehensive insight of all taxpayer’s activity;

4

Security of the whole system is based on proven technologies (PKI) and does not rely on 3rd party invoicing systems and device Vendors.

For Taxpayers

1

Protecting honest taxpayers from unfair competition;

2

Minimizing the cost of compliance per taxpayer and per sales point;

3

Free Compliance (for some businesses);

4

Simplified Tax Returns;

5

Registration of both sales and purchases in business-to-business transactions enables easy cross-checking for processing tax returns and tax refunds;

For Customers

1

Rise of consumer awareness by receiving certified invoices with clear and true specification of tax amount dedicated to the government;

2

Getting incentives for activities under the Customer Compliance Aware (CCA) program;

3

Paperless transactions (i.e. scan QR Code on point of sale to transfer receipt to a customer or send an invoice by email).

For Invoicing system vendors

1

Transparency and level playing field for all suppliers of fiscal equipment, accreditation helps level the field for everybody;

2

Affordable and simple Accreditation Process for all developers/vendors;

3

Modernizing sale outlets with advanced, ever-evolving management tools designed to better serve taxpayers' business;

Seven Underlying Principles For The Electronic Solution

1. Equal conditions for all taxpayers ensure a level playing field for businesses.

2. Our system prioritizes simplicity, benefiting Tax Authorities, taxpayers, and consumers alike.

3. We strive to minimize administrative burdens and compliance costs for taxpayers.

4. Transparency is paramount in our collaboration between Tax Authorities, suppliers, and taxpayers.

5. Public participation in invoice verification is incentivized, promoting heightened awareness.

6. Robust anti-fraud measures ensure security and integrity.

7. Our solution minimizes costs for Tax Authorities, optimizing efficiency.

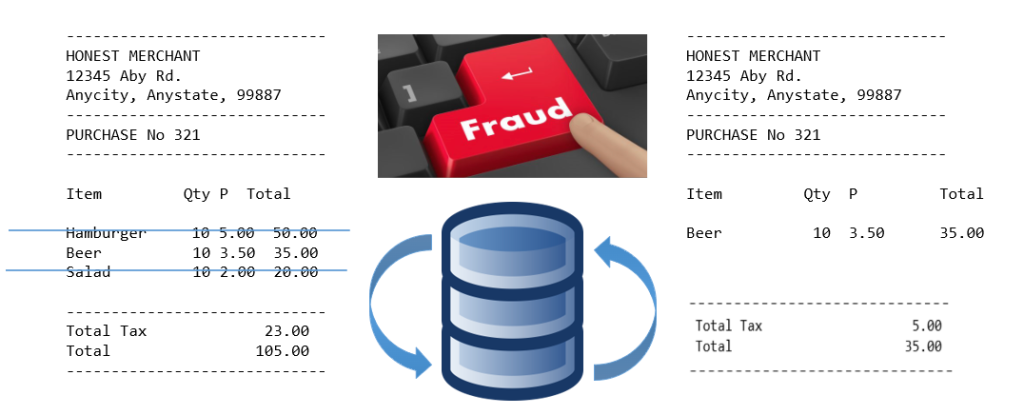

Secure Anti-Fraud Measures

Zapper and Phantomware-proof

The cornerstone of our system lies in the Secure Element (SE) coupled with the Sales Data Controller (SDC). Encrypted SE data can only be accessed by the Tax Authority, housing transaction records since the last audit, providing a comprehensive overview of activity.

Our robust measures thwart illegal software attempts to delete transactions, as SE registers safeguard original sales evidence, ensuring data integrity during and after transactions. Updates to SE registers during transmission to TaxCore reconcile any missing invoices.

BUILD TO BOOST BOTH REVENUE AND EFFICIENCY

TaxCore® is

secure

easy

to manage.

- User-friendly interface makes training quick and easy

- Powerful features allow you to do far more with a small staff

- Foolproof anti-fraud features broaden the tax base dramatically

Boost tax revenue, while lowering tax rates and increasing department efficiency – make your country’s dream come true!

TaxCore® is very simple to use, and its main purpose is to digitalize fiscal and tax collecting systems. The main issue with many tax collecting systems in the world is that they are too paper-based and bureaucratic, which means they are still stuck in the 20th century.

Therefore, they are easily exposed to fraud and evasion. The basis of TaxCore® is that every transaction must be digitally signed at the point of origin and that it must be easily verified and validated at the moment of issuing, regardless of whether the taxpayer is online or offline at the moment of issuing.

Once an agreement with a Tax Authority has been reached, we lead our clients through our robust implementation process.

Each step in the implementation of TaxCore® plays a pivotal role in ensuring the seamless functioning of the system.

Choose Electronic Fiscal Device (EFD) components independently and tailor them to best suit your budget and business needs.

No longer tethered to traditional cash registers, TaxCore® allows taxpayers to use a user-friendly app on their smartphones that effortlessly serves as a Point of Sale machine.

For taxpayers, this means streamlined compliance and reduced costs. For Tax Authorities, it ensures swift and effortless adherence to local regulations.

While TaxCore® primarily operates online, we understand that internet connections still aren’t 100% stable and reliable. That’s why TaxCore® offers three modes of operation: fully online, semi-online, and offline.

In the fully online mode, all data is securely transmitted to the Tax Authority instantly via a stable internet connection.

For those in retail who can’t risk losing customers due to internet issues, we developed the semi-online mode. It’s not just for businesses with connectivity problems; it’s also ideal for busy establishments that need to immediately at the point of sale issue a receipt without exception. The Electronic Fiscal Device (EFD) stores all information locally and forwards it to the data center later.

The offline mode is for taxpayers without internet access. They can use an external Sales Data Controller to issue receipts offline, storing all data for later retrieval by an inspector.

In all cases, receipts are digitally signed by the taxpayer’s digital certificate, and instantly verifiable, while data remains securely on the taxpayer’s premises.

TaxCore’s standout feature is the invoicing system:

With TaxCore®, you can choose to issue a traditional fiscal receipt to your customers. But our receipts are different – they’re clear, concise, and feature a QR code at the bottom. This QR code links to the digital version of the receipt, accessible via smartphone.

When a customer scans the receipt’s QR code, they’re automatically entered into the Customer Compliance Award program, giving them a chance to win prizes. But beyond that, scanning ensures compliance and verification. Anyone can also report any discrepancies you spot on the receipt, protecting their rights and potentially winning more prizes.

For Tax Authorities, enabling receipt scanning helps identify businesses exploiting fiscal loopholes. Each reported discrepancy presents an opportunity to enforce tax laws and maintain fairness across the board.

Instead of issuing physical receipts, TaxCore® allows you to simply display a QR code on a customer-facing screen. When scanned, they instantly receive the digital receipt, leading to quicker transactions and happier customers.

TaxCore® stands as a steadfast partner, dedicated to providing comprehensive guidance on its utilization. Our team conducts thorough training sessions for Tax Authority personnel through presentations and webinars.

Additionally, an abundance of supplementary materials is available on the TaxCore® website help center to further support personnel in mastering the platform.

TaxCore® offers transparent interface specifications and detailed instructions for developers of Point of Sale and E-SDC devices.

Accreditation is granted to devices that meet these specifications, fostering a level playing field where developers can compete based on price and quality. This not only cultivates a fair and competitive business environment but also encourages innovation and drives down prices.

Additionally, TaxCore® provides a development portal tailored for vendors, aiding them in ensuring compliance, testing devices, and seamlessly introducing new products to the market.

TaxCore® has demonstrated remarkable success, notably boosting tax collection revenues in countries where it’s been implemented. By incentivizing consumers to request and scan receipts, TaxCore® emerges as a formidable asset in governments’ battle against the informal economy.

Our objective is to foster seamless collaboration between taxpayers (collecting agents) and Tax Authorities, cultivating an environment conducive to growth and development.