Even though laws against electronic sales suppression software have been elected in most of the United States, (NY State introduced it almost a decade ago), the battle against ESS is still on-going. This is naturally not a result of an ineffective government; we are witnessing a lot of states doing their best to catch taxpayers who commit this type of fraud. The problem lies much deeper than that – it’s in the complexity of the system itself.

Professor Richard Ainsworth of Boston University, an expert on international sales tax collection and fraud prevention, offered an overview of the extent of the problem at the forum on modernizing sales tax collection in NYS held by State Senator Liz Krueger in 2016. According to Ainsworth, New York State loses around a staggering $1.7 billion each year due to electronic sales suppression. “Zapper” software, which allows users to falsify sales receipts, previously came in the form of CDs or USB thumb drives, but increasingly sophisticated software is now available to download online, making it nearly impossible to track down producers. Professor Ainsworth’s written statement can be viewed here.

The zapper Case in Minnesota roots from New York City

Recently, a fraudster from NYC caused a lot of troubles for the Minnesota Department of Revenue. The authorities charged Mr. Hailong Li with manufacturing and providing Sales Suppression devices to businesses, helping them commit tax fraud. They elected this as the first case charged under Minnesota’s electronic sales suppression devices law enacted in 2017.

The specific software called “Happy World” helped business owners modify their sales records, enabling them to reduce the amount of sales tax they owed to the state without leaving one shred of audit trail. And although Mr. Li, the creator of the software, denies ever selling it to people since the law came to force in 2017, the authorities still arrested him due to firm proof that he did just that. He provided his customers with remote support using TeamViewer to log into their terminals and tweak the sales records. During the first investigation of Osaka Duluth, Minnesota Revenue officers seized a flash drive containing Mr. Li’s software program. The authorities discovered Happy World in a second criminal investigation of Shogun Burnsville and the third case of Raku, Inc.

According to this law, (Minnesota Statute: 289A.63.2(b), with reference to 609.03.1), a maximum sentence of 5 years in prison or $10,000 fine. Sometimes, it can be both.

Having firm and harsh laws against tax fraud is a very good way to fight it, however, it is usually not enough. Mr. Li is only one of the people caught red-handed; all over the USA, sales suppression devices and software keep preventing the States from collecting taxes properly. This is further feeding the grey economy, as well as endangering consumers’ rights. If a certain business owner isn’t paying sales taxes, shouldn’t this mean that the prices for the consumers are lower as well? No, it’s not.

How Can TaxCore Help?

TaxCore is not new to the American market. Moreover, it already works in the State of Washington. To be more precise, the State of Washington Department of Revenue has entered into an agreement with well-known restaurants – and its proving to be working effectively.

The authorities caught the owner of the restaurant using a sales suppression software, however, the plea that resulted in an agreement helped TaxCore enter the US market.The business owner accepted the implementation of a monitoring software into their restaurant. Naturally, by breaking the law, the fines were huge. The business owner even had to pay for all the taxes they tried to hide.

The reason why TaxCore was the one chosen as a monitoring system for the restaurant was due to its transparency and flexibility. The owner still had access to the full functionality of the POS, including plug-ins for popular delivery services, while the monitoring in the background is active.

In a developed country such as the USA, there are usually no issues with internet connectivity, which allows for business owners to connect to the Department of Revenue 24/7. This means that with TaxCore, the business digitally signs and directly forwards every single receipt issued to the DOR server.

In a developed country such as the USA, there are usually no issues with internet connectivity, which allows for business owners to connect to the Department of Revenue 24/7. This means that with TaxCore, the business digitally signs and directly forwards every single receipt issued to the DOR server.

TaxCore notices discrepancies

This leaves no space for tax and sales fraud because the system detects any discrepancies (e.g., the system will detect sudden gaps in forwarded receipts for a certain amount of time, mismatches with the POS ticket sequences, and similar issues). Even if the internet connection is unstable, using a secure element, TaxCore lets business owners save their receipts until the internet connection is back, without customers noticing because verification service will work regardless of the mode POS is in at the moment.

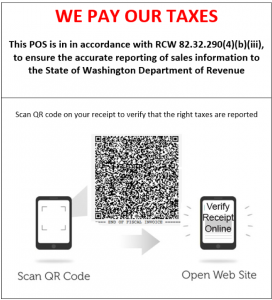

Moreover, TaxCore’s proof of audit technology can easily disable a business from issuing any receipts at all if the system misses or can’t audit some of them. Additionally, TaxCore’s receipts come with a customer scannable QR code (or in this case, a guest) and can easily report if something doesn’t sit right with them.

Using a taxpayer who committed tax fraud as testing grounds for a pilot project was a very good decision by the State of Washington. It proved that it is possible to educate and correct taxpayers easily, but more importantly, it proved that TaxCore is the perfect system that leaves no space for tax evasion. Years after authorities caught them committing tax fraud, the business owners in Seattle are still using TaxCore and are completely abiding by the law.