Revenue compliance management - TaxCore® a powerful tool

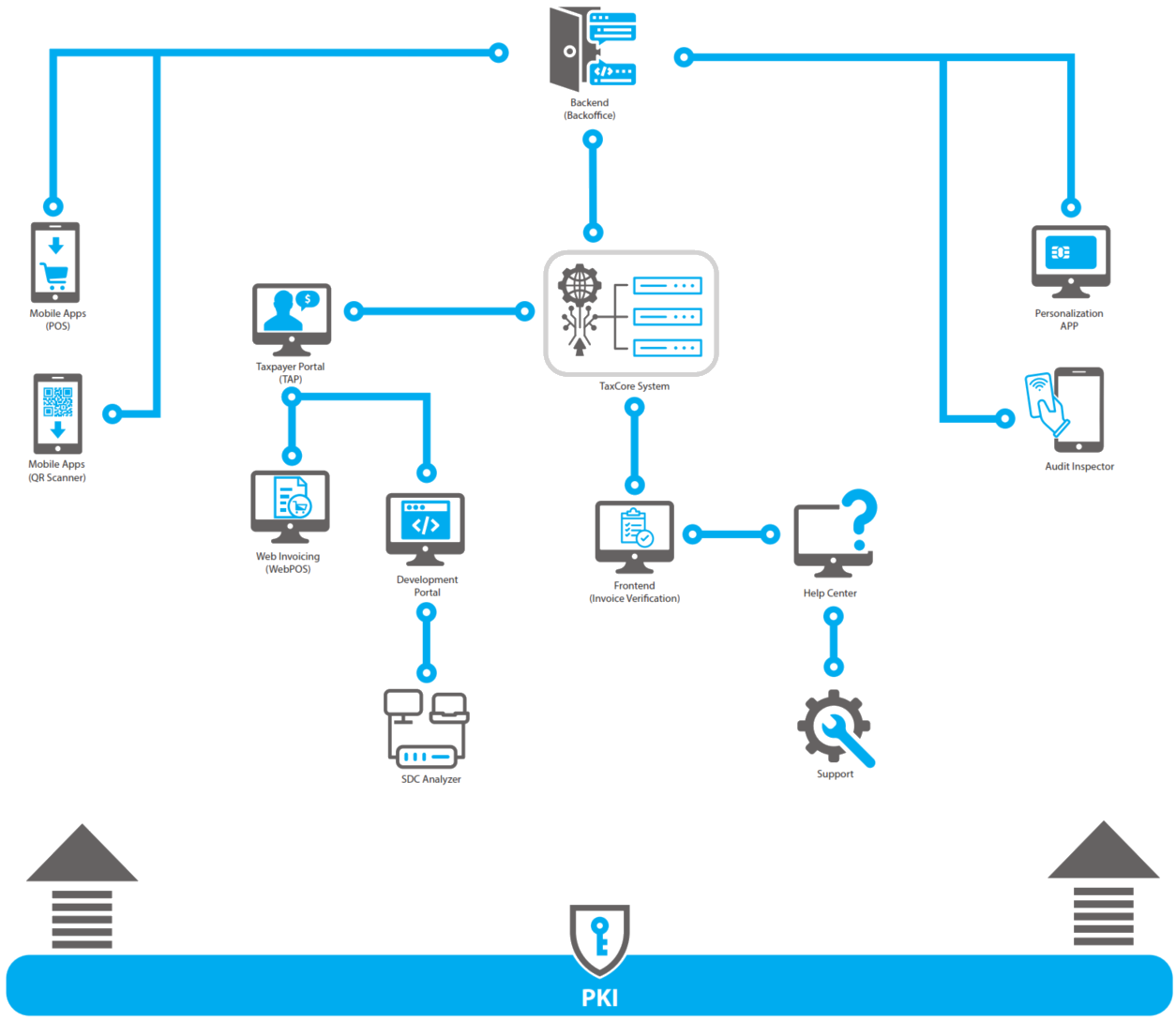

Independent of the Tax Administration System, TaxCore® comes packed with powerful tools and features to manage the whole indirect tax compliance monitoring process.

All governments dream of near-complete compliance, higher revenues, a broader tax base with lower rates – and a light-touch, cost-efficient administration. This is now possible.

TaxCore® Features

Secure Element

Taxpayer Identity

Every Secure Element (SE) bears information about taxpayer ID, name, location, address, etc. sourced from the official registry of taxpayers. Thanks to this, all relevant information are shared with concerned stakeholders assuring data is 100% accurate and up to date.

Digital Signature

Secure Elements are issued by Tax Authority and serve to apply digital signature to every transaction. This safeguards all relevant data from fiscal receipt or invoice, assuring non-repudiation and eliminating any possibility for record manipulation.

Fiscal Counters

Unique counters are critical for managing large volumes of transactions and having a clear audit trail. Every Secure Element maintains its own set of counters enabling efficient audit and exposing any gap occurrences.

Processes

Enrollment

TaxCore® can send invitations automatically to concerned individuals or group of taxpayers or Enrolment Officer may invite each taxpayer separately. A taxpayer will be offered to manage locations and order required Secure Elements to cover all sales points using Taxpayer Administration Portal (TAP).

CCA (Customer Compliance Award)

The Customer Compliance Award is a way to incentivise customers to always ask for the invoice after a purchase. They can scan the QR code on the invoice and automatically get enrolled in the lottery which can offers various prizes made available and easily managed by Tax Authority or 3rd party sponsors.

AIS and SDC Vendor Accreditation

TaxCore® Development Portal serves AIS and E-SDC developers to ensure their software or devices comply with technical instructions. Vendors register with the TA, make a self-assessment for accreditation, and test their solutions using online Sandbox. All process can be easily managed remotely.

Security & Audit

Audit Package

An audit package is a small bundle of data that holds all the information about a single sales transaction. It is sent to TaxCore® Back Office via the internet or physically, e.g. on a flash drive.

Proof of Audit (PoA)

When all expected audit packages have been received, TaxCore® Back Office checks and records them, and returns a PoA to the taxpayer’s EFD (Electronic Fiscal Device). This is done in almost real-time.

Online (remote) and Offline (local) audit

TaxCore® works online and offline. Remote audits occur online, with local audits manually completed with poor internet, using methods like SD cards or USB drives.

Applications

TaxCore® Back Office

The Back Office receives audit packages, verifies data, and issues PoA with unique transaction IDs. It provides comprehensive insights for Tax Inspectors and Tax Authority staff. Wall-mounted monitors in network centers display real-time data for Tax Authority executives.

Taxpayer Administration Portal (TAP)

The TAP is a portal for taxpayers. From it, every taxpayer can log on to a dashboard using their PIN, and view a log of issued invoices. Useful for checking revenue records and data recovery, e.g. after accidental data loss.

Free POS (mobile + web app)

Mobile apps are available free of charge on Android and iOS webstores BYOD (bring-your-own-device). With these apps, taxpayers can fiscalize their issued invoices to be compliant with the TA's fiscalization laws, they are easy to use and configure!

Invoice Verification Site

Fraud detection by the public eye! Customers and anyone interested can scan and verify any invoice type, just as a tax authority inspector does. All invoice details are shown. Fraud detection has never been easier, open, and available to everybody!

QR scanner (mobile app)

A customer/inspector simply scans the QR code or clicks on the verification URL. When the Invoice Verification Service finishes with the verification, it displays the invoice status (public invoice validation tags) on the Invoice Verification Page.

Help Viewer

Anyone can access our user documentation and learn about the concepts, processes, applications or technical documentation belonging to our TaxCore® system. Advanced search engine options are available in the app to ensure quick and faster results.