From January 1st 2022, all companies with a physical address in Spain’s northern territory will be obliged to use an special invoicing software for their receipts that directly reports to the Basque Country Tax Authority: TicketBai. This change will affect all merchants, regardless of their activity and this new measure is possible because of two different Tax Authorities that coexist in Spain, one for the rest of Spain and one specifically for this northern autonomous community.

How does TicketBai works?

To be able to use TicketBai’s invoicing system, taxpayers will need to have a specific software validated by the Tax Authority’s institutions that can generate QR and TBAI codes in their receipts or invoices submitted. TBAI, which gives its name to the whole program, refers to the invoice’s ID number in the system’s database and proves the relationship between an invoice and its subsequently generated TBAI file. This file is then submitted to the Tax Authority certifying that the information was correctly received.

To be able to use TicketBai’s invoicing system, taxpayers will need to have a specific software validated by the Tax Authority’s institutions that can generate QR and TBAI codes in their receipts or invoices submitted. TBAI, which gives its name to the whole program, refers to the invoice’s ID number in the system’s database and proves the relationship between an invoice and its subsequently generated TBAI file. This file is then submitted to the Tax Authority certifying that the information was correctly received.

The invoicing software that taxpayers will need to use has to comply with the following criteria:

- Generate invoices for each product or service sold.

- Sign using a digital certificate that makes it possible to introduce the QR ad TBAI codes.

- The ability to send that information to the Tax Authority.

- Lastly, that it has the capacity of creating a BAI file.

Taxpayers who do not possess an invoicing software compatible with TicketBai will need to replace it with another new invoicing system that is able to adapt to these new requirements.

Why TicketBai?

The main focus of this new system is to effectively control the cash registers belonging to specific sectors handling with payments in cash and which were not doing receipts or legal invoices as expected.

The Basque Country’s Tax Authorities have estimated that up to 90% of small retailers follow the above-mentioned practices to evade taxation. For instance, in 2016, Bizkaia’s region reported to the Tax Authority to have discovered 450 million euros belonging to tax fraud in the year 2015 alone.

To foster this initiative and make everyone comply with TicketBai regulations, there will be two types of new sanctions: one for not complying with the law and another one for destruction, manipulation or data deletion. Sanctions vary depending on each case, but those not complying with the law will have to pay a penalty of up to 20% of their last year’s turnover, a minimum of 20.000€, regardless of their turnover capacity or type of business.

The tax authorities adopt a similar approach for those manipulating, destroying or deleting valuable data, in this case, penalties will amount to up to 20% of their last year’s turnover, a minimum of 40.000€ and they can affect both the supplier and the user of that invoicing system. In case of a repeated offender, sanctions will amount to up to 30% of their last year’s turnover in both cases and to 60.000€ minimum penalty for destruction, manipulation or deletion of data whereas for lack of compliance, penalties will reach a 30.000€ minimum. These are harsh measures that show how much the Tax Authority is willing to punish infractions and avoid fiscal fraud at all costs.

Any incentives?

There are incentives too; for those companies adopting the system earlier there will be a 30% income tax reduction or a 60% income tax decrease depending on the region in which those businesses are located, with a maximum deduction of 5.000€ for over one year.

Next step, Spain?

While in Spain there is not yet a defined project to extend this system, the idea is to implement it to the rest of the country progressively. This is due to the fact that the Spanish Tax Authorities have seen similar positive results in the rest of the European Union, and they have experienced also some good results by adopting the SII system that is now able to collect a third of the total VAT revenues in Spain augmenting them by 17%.

It is clear that with the advancement and proliferation of new technologies capable of monitoring tax activity as well as detecting tax fraud, more and more countries will invest in implementing similar strategies to foster tax revenue and avoid tax fraud.

TaxCore® and what it offers

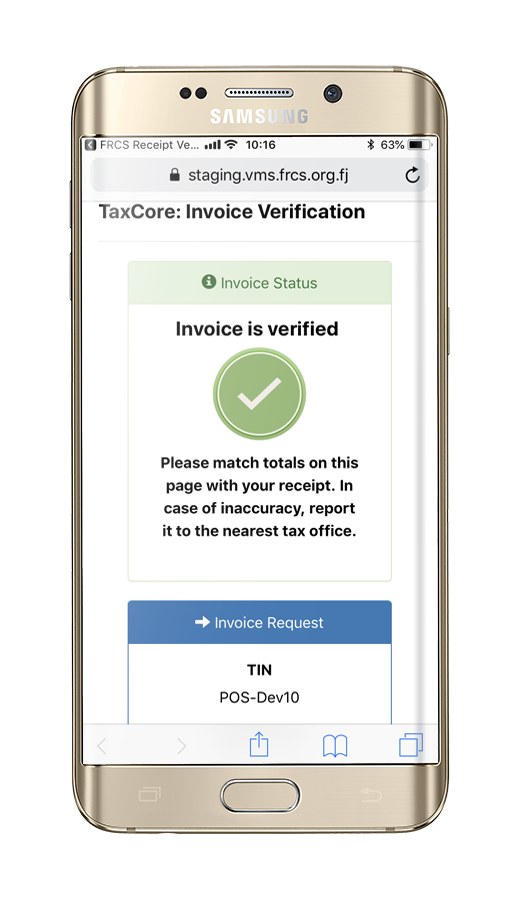

With the successful implementation of TaxCore® in Fiji and Samoa, the Tax Authorities of those countries are sure to monitor and collect the tax revenues that are due to them from taxpayers, making sure also to fight against the gray economy, compensating and rewarding those who comply with the model. The system works perfectly with the Tax Authorities as the system sends the information in real-time and every receipt is verifiable. They ensure collaboration from the general consumer population by rewarding the ones reporting any discrepancies or issues they may experience with their invoices or receipts, as for each scanned or reported invoice consumers can win prizes from vendors, working as a lottery for them.

With the successful implementation of TaxCore® in Fiji and Samoa, the Tax Authorities of those countries are sure to monitor and collect the tax revenues that are due to them from taxpayers, making sure also to fight against the gray economy, compensating and rewarding those who comply with the model. The system works perfectly with the Tax Authorities as the system sends the information in real-time and every receipt is verifiable. They ensure collaboration from the general consumer population by rewarding the ones reporting any discrepancies or issues they may experience with their invoices or receipts, as for each scanned or reported invoice consumers can win prizes from vendors, working as a lottery for them.

Taxpayers also benefit from this experience the system protects them from unfair competition coming from fraudsters, it minimizes the cost of compliance per taxpayer and sales point and it also improves and simplifies communication between taxpayers and Tax Authorities, as the system performs reporting in real-time making the tax administration more approachable and reducing the chances of misunderstanding from both sides.

To conclude, this new fiscalization system procedure adopted by the Basque Country’s Tax Authorities is a step in the good direction towards ensuring a proper tax return for this region. If well implemented, it will help them track down fraudsters easier and quicker, in real-time, making sure also that the resources that were previously dedicated to tax fraud investigation are used elsewhere where they are needed the most and engaging all actors in the economy to participate and collaborate towards the same goal, a just and effective tax system.